Welcome to the world of Python programming for finance! Python is not only a powerful tool for software development but also a preferred language for financial analysis and modelling. In this beginner’s guide, we’ll explore how Python can be used in the context of finance.

Why Python for Finance?

Python’s simplicity, readability, and extensive libraries make it an ideal choice for financial analysis and modelling. Let’s delve into some examples to understand why Python is the preferred language for finance professionals.

Important Financial Concepts

Before we proceed with the examples, let’s briefly cover some important financial concepts that we’ll encounter:

- Returns: Returns measure the profit or loss generated by an investment over a specific period. They are typically expressed as a percentage of the initial investment.

- Risk Management: Risk management involves identifying, assessing, and prioritising risks followed by coordinated and economical application of resources to minimise, monitor, and control the probability and impact of unfortunate events.

- Moving Averages: Moving averages smooth out price data to identify trends over a specified time period. They are commonly used in technical analysis to determine the direction of a market trend.

Examples

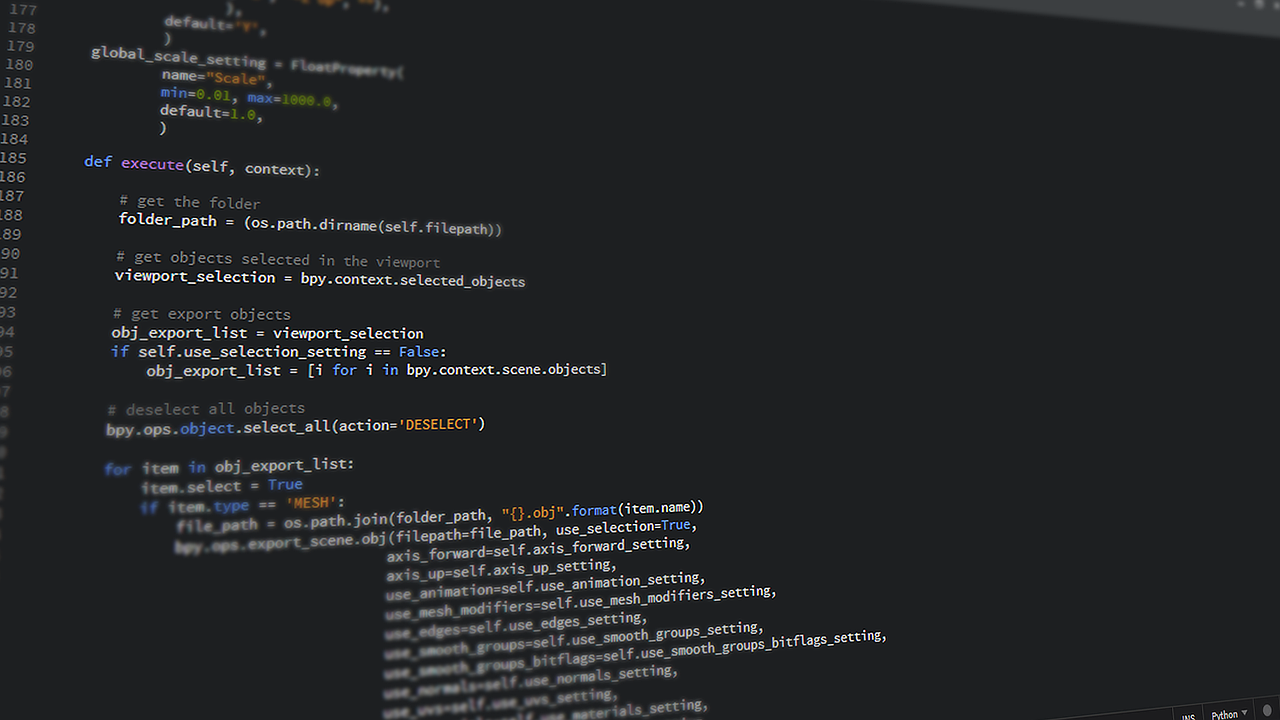

1. Financial Data Analysis

Python’s pandas library provides powerful tools for data manipulation and analysis. For example, we can use pandas to load financial data from CSV files, calculate various financial metrics such as returns and volatility, and visualise the data using libraries like Matplotlib or Seaborn.

import pandas as pd

import matplotlib.pyplot as plt

# Load data from CSV file

data = pd.read_csv('stock_data.csv')

# Calculate daily returns

data['Returns'] = data['Close'].pct_change()

# Plot stock price and returns

plt.plot(data['Date'], data['Close'], label='Stock Price')

plt.plot(data['Date'], data['Returns'], label='Returns')

plt.legend()

plt.show()

2. Algorithmic Trading

Python’s simplicity and flexibility make it well-suited for algorithmic trading strategies. With libraries like NumPy and SciPy, we can implement mathematical models to analyse market trends, develop trading signals, and automate trading strategies using platforms like MetaTrader or Interactive Brokers.

# Implement algorithmic trading strategy

if data['SMA50'] > data['SMA200']:

print("Buy Signal")

else:

print("Sell Signal")3. Risk Management

Python can be used to build risk management systems to assess and mitigate financial risks. For instance, we can calculate Value at Risk (VaR) or Conditional Value at Risk (CVaR) using statistical methods implemented in Python libraries, helping traders and investors manage portfolio risk effectively.

# Implement risk management rule

if portfolio_value > max_loss:

print("Risk Exceeded. Close Positions")Data Structures

Python’s built-in data structures are useful for organising and analysing financial data:

- Lists: Lists are versatile data structures that can store collections of financial assets, data points, or trading signals for analysis. They allow for easy iteration, modification, and manipulation of data.

# Create a list of stock symbols

stocks = ['AAPL', 'GOOGL', 'AMZN', 'MSFT']

# Iterate over the list and perform operations

for stock in stocks:

print(f"Analyzing stock: {stock}")- Dictionaries: Dictionaries are key-value pairs that can represent financial data or metadata. They provide a convenient way to store and retrieve information associated with financial assets, such as ticker symbols, company names, or sector classifications.

# Create a dictionary of stock prices

prices = {'AAPL': 150.25, 'GOOGL': 2800.50, 'AMZN': 3500.75, 'MSFT': 300.00}

# Retrieve price of a specific stock

print("Price of AAPL:", prices['AAPL'])- Sets: Sets are unordered collections of unique elements. They are useful for eliminating duplicate values and performing mathematical set operations such as union, intersection, and difference.

# Create a set of unique stock symbols

unique_stocks = {'AAPL', 'GOOGL', 'AMZN', 'MSFT', 'AAPL'}

# Print unique stock symbols

print("Unique stocks:", unique_stocks)- Tuples: Tuples are immutable sequences, typically used to store collections of heterogeneous data. They are useful for representing fixed-size records or returning multiple values from a function.

# Create a tuple representing a stock trade

trade = ('AAPL', '2022-01-01', 150.25, 100)

# Print trade details

print("Trade details:", trade)Control Flow

Python’s control flow structures can be used in financial analysis to implement trading strategies and risk management techniques.

- Conditional Statements: Conditional statements, such as if-else statements, are used to make decisions based on certain conditions. They are essential for implementing trading signals and risk management rules.

# Implement trading signal based on moving average crossover

if data['SMA50'] > data['SMA200']:

print("Buy Signal")

else:

print("Sell Signal")- Loops: Loops, such as for loops and while loops, are used to iterate over data structures and perform operations on each element. They are useful for analysing multiple financial assets or processing large datasets.

# Iterate over a list of stock symbols and perform analysis

for stock in stocks:

print(f"Analyzing stock: {stock}")

# Use a while loop to implement a trading strategy

while portfolio_value > max_loss:

print("Executing trading strategy...")Additional Python Resources

Web resources:

Courses

- Python and Statistics for Financial Analysis

- Python for Finance: Investment Fundamentals & Data Analytics

- Investment Management with Python and Machine Learning Specialization

Books

Conclusion

Congratulations! You’ve taken your first steps into using Python for financial analysis. In this beginner’s guide, we’ve explored Python’s suitability for financial applications, set up the programming environment, and learned about basic syntax, control flow, and data structures in the context of finance. Stay tuned for more advanced topics and happy coding in Python!